Contents

Maintaining finances was a big struggle this year; with quarantine in action and everyone at home, it was a struggle to keep everything under control, from food to utilities and medical bills that insurance does not cover.

Nonetheless, the fact that you now realize how important it is to budget, especially for the newcomers who have just begun earning for themselves and are living on their own. The newly found independence can be intimidating and misleading, which may cause you to spend way more than you should.

But do not worry; numerous methods will help you maintain your monthly budget and manage your finances for the coming year of 2021.

But before any of that, there are a few things that you must prepare beforehand. Start by evaluating your general expenses based on your monthly income. This includes rent, utilities, and basic groceries that you will require every month for sure.

Speaking of utilities, you can slash a significant amount off of it by getting rid of your cable TV that alone costs as much as all the other utilities combined. Instead, stream Hulu, Netflix, Amazon Prime at much cheaper rates, providing you flexibility and content of your choice. Along with helping you save almost 3/4th of the amount.

The rest of the amount needs to be sorted into categories based on your need and requirement. If you are moving out to a new place, you may need new furniture, household items to set your house. Dedicate an amount for it and set it aside as your monthly goal.

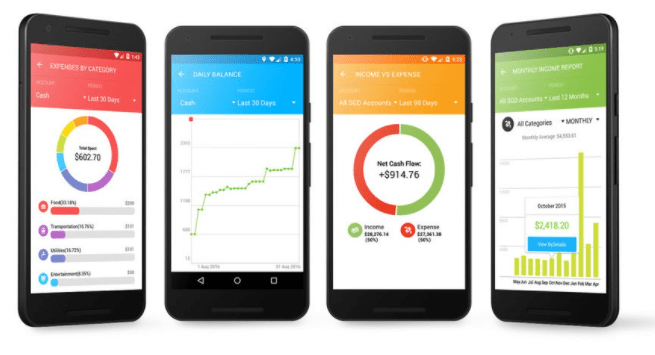

If you already live on your own and want to spend or invest in inexpensive items, then do your research and plan things accordingly. Since we recommend apps to sort out your finances, some of them will require your bank and credit card details. All this comes under sensitive information that needs a guard to protect it.

Top Finance Apps to Use

Mint

Mint is amongst the top budgeting apps in the market right now. It is entirely free, and to take things a notch above. It is linked to all your credit cards and bank accounts and keeps track of all your spending in real-time. It categorizes all your expenses in maintaining a fixed budget. Mint will alert you if your budget is exceeding the limit set by you. It enables an email reminder for your bill payments according to the due dates. Moreover, in recent updates, the app can now keep track of your credit score and help you monitor it to maintain a healthy score overall.

Also read: 5 Marketing Ideas To Heighten Your Small Business

YNAB (You Need a Budget)

On number 2, we have You need a Budget. This app is not free but comes with a 34-day free trial before charging $11.99/month or $84/year. If you are a student, you get an additional 12-month free. YNAB, too is connected to your bank accounts and helps you maintain a strict budget based on your goals set by you. It helps you set aside an amount that will contribute to your savings. Apart from all this, you can access workshops and guides to help you plan and budget based on your needs and priorities.

Spendee

Spendee is a shared wallet with a beautiful and user-friendly interface. You can keep track of all your expenses along with that of your household if you live in a joint family. Just like other apps, you can import your bank transactions and details here. Spendee also gives you the option to enter any cash-based expenses manually. It keeps track of your bill payments and makes sure you do not pay any penalty due to late payments with its alerts.

Spendee is super affordable at $2.99/month and $22.99/year on its Premium plan, giving complete access to all the features and facilities, which are otherwise limited or unavailable in its Plus and basic plans.

Personal Capital

Originally an investment management app, Personal Capital also offers services to track and maintain your monthly budget and track all your expenses. It categorizes all your spendings and finds out what percentage of your monthly budget goes in that category. The app offers features that help you meet your investment goal. Topping it all of, you even get financial advice from registered advisors who help you achieve your goals effectively.